Yes No skip to question 4 If Yes indicate the dollar amount of self-employment deductions you had in 2021 for the following. W-2s are very helpful when showing proof of self employment income from a company or agency.

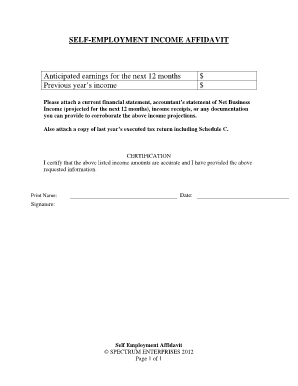

Affidavit Of Self Employment Income Fill Online Printable Fillable Blank Pdffiller

Unemployment or disability benefits.

. Filing Status _____ b. Hello friends in this video I will show you how to fill out form i-864 known as affidavit of support my friend asked me to fill out an affidavit of support for her husband because her income is not enough to meet the 125 percent of the federal poverty guideline okay in this section we are now going to touch this section this is only for USCIS use we are going to a start from here down. Use the following self.

A 1099 form is filled with any person or entity that has paid you. This is especially true if youre self-employed. Unless your self-employment involves dealing and brokering investment.

Sales from self-employed resources Avon Mary Kay Pampered Chef etc. Monthly mandatory retirement payments 23. This rate consists of 124 for social security and 29 for Medicare taxes.

To prove that youre an eligible beneficiary to the program youll need to certify your income and assets for evaluation purposes. Were you self-employed at any time during 2021. _____ Monthly Workers Compensation.

Earned income does not include amounts such as pensions and annuities welfare benefits unemployment compensation workers compensation benefits or social security benefits. Overall declaring yourself as a self-employed person means stating exactly everything you deal in even if it is an activity that does not earn your business any profit. Monthly mandatory union dues 22.

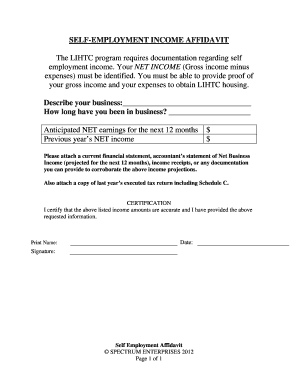

The answer is yesWrite an income verification letter and use the following accepted documentation to prove your income. When you apply for Marketplace coverage you must report. If youre self-employed you may be asked to upload a self-employment ledger to confirm your income.

Therefore they will only show earnings for the previous year. Fortunately its extremely easy to secure an Employment Affidavit if you take the appropriate measures as outlined in. If you are sponsoring more than one intending immigrant listed on the same affidavit of support photocopies of the original affidavit of support may be submitted for any additional intending.

The law sets the self-employment tax rate as a percentage of your net earnings from self-employment. Proving income while self-employed can take a little extra effort if you dont keep yourself organized. So can you write a proof of income letter for self-employment on your behalf.

Number of dependents claimed _____ 19. If you are sponsoring more than one intending immigrant listed on the same affidavit of support photocopies of the original affidavit of support may be submitted for any additional intending. Proof of Income for Self Employed Individuals.

Self-employed green card sponsors. An employment verification letter or proof of employment is a form that verifies the income or salary earned by an employed individual. There isnt a standard self-employment ledger format.

Wage and Tax Statement for Self Employed. DInterest or dividends from assets. It just needs to provide an accurate detailed record of your self-employment income and expenses.

If you are currently self-employed a copy of your Schedule C D E or F from your most recent Federal income tax return which establishes your income from your business. Monthly Medicare payments 21. The verbal VOE requirement is intended to help lenders mitigate risk by confirming as late in the process as possible that the borrower remains employed as originally disclosed on.

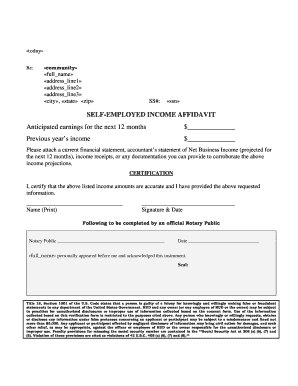

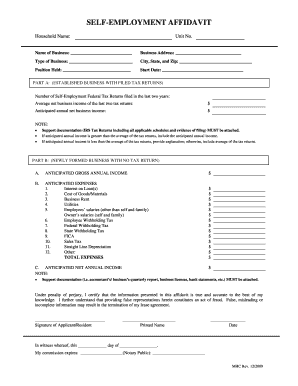

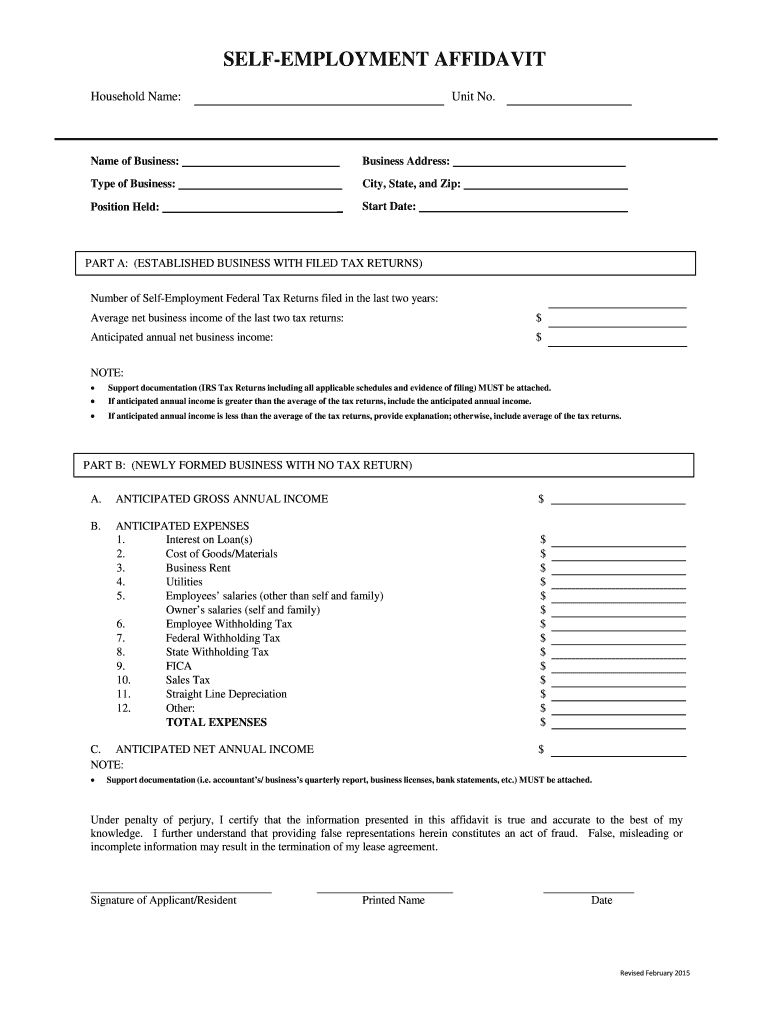

As a self-employed individual this information must be documented in a sworn affidavit. Self-employment declaration is significant for income tax purposes because there is an expectation of profit and evidence to support the existence and continuity of an enterprise. Updated June 03 2022.

Earned income also includes net earnings from self-employment. Monthly federal state and local income tax corrected for filing status and allowable dependents and income tax liabilities a. For tax years after 2003 members of the military who receive excludable combat zone compensation may elect.

What Is Not Considered Self-Employment Income. Additional Medicare Tax applies to self-employment income above a threshold. Proof of Income for Self Employed Individuals.

The same goes for income received from an activity that fits the narrow IRS definition of a hobby. Take a look at the documents below to see what you can use to prove your income when you are self-employed. Monthly FICA or self-employment taxes 20.

These forms prove your wages and taxes as. _____ Monthly disability benefitsSSI 5. These amounts are calculated by using the T2125 Statement of Business Activities form which is a part of your personal income tax return.

The threshold amounts are 250000 for a. If you are self-employed no one can provide employment income verification except yourself. Report your self-employment income on separate lines for each source by entering your gross income and net income in lines 13500 to 14300 of your income tax and benefit return.

Wages from employment including commissions tips bonuses fees etc. _____ Monthly business income from sources such as self-employment partnerships close corporations andor independent contracts Gross receipts minus ordinary and necessary expenses required to produce incomeAttach sheet itemizing such income and expenses 4. Keep in mind that W-2s are yearly statements.

Depreciation deduction greater than depreciation calculated on a straight-line basis for purposes. The requestor of the employment information will use the form to confirm that an individual. Any form of income that is documented on a 1099 is also acceptable as proof of income.

If you are currently self-employed a copy of your Schedule C D E or F from your most recent federal income tax return which establishes your income from your business. Income for which you received a W-2which would mean you are an employeecannot be calculated as self-employment income. Immigration officers primarily rely on a sponsoring relatives individual federal income-tax return for evaluating a family-based or marriage-based green card application but some situations call for additional evidence to prove your eligibility to sponsor.

CRental income from real estate or personal property. Other income to report. BIncome from the operation of a business.

Self-Employment Tax Rate. The verbal VOE must be obtained within 10 business days prior to the note date for employment income and within 120 calendar days prior to the note date for self-employment income. This type of verification letter is commonly used when someone seeks housing or is applying for a mortgage.

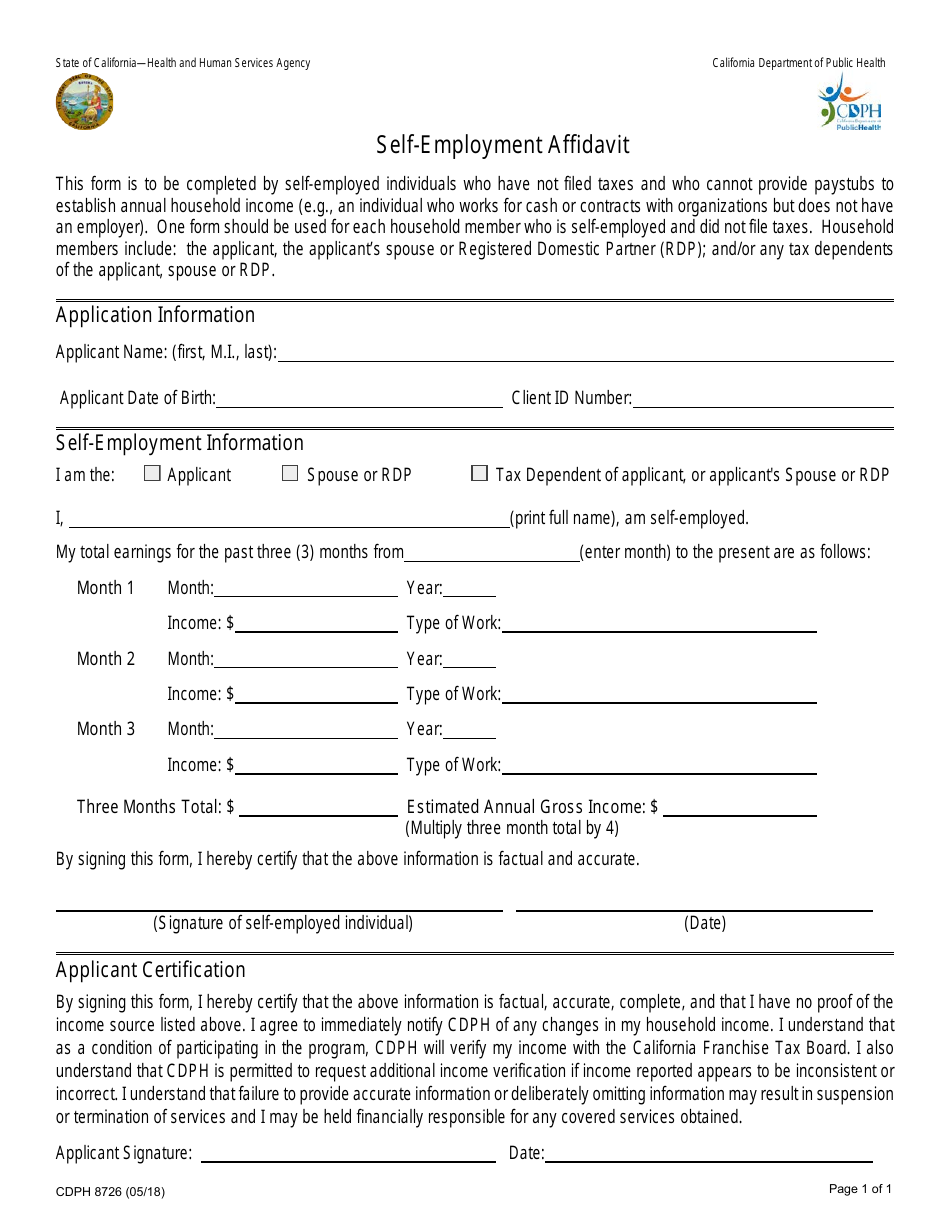

Form Cdph8726 Download Fillable Pdf Or Fill Online Self Employment Affidavit California Templateroller

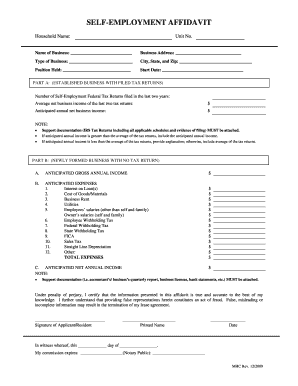

Signed Affidavit Verifying Self Employment Fill Online Printable Fillable Blank Pdffiller

Signed Affidavits Verifying Your Self Employment Form Fill Out And Sign Printable Pdf Template Signnow

Self Employment Affidavit For Unemployment Fill Online Printable Fillable Blank Pdffiller

Self Employment Affidavit 2015 2022 Complete Legal Document Online Us Legal Forms

Affidavit Of Self Employment Income Form Fill Out And Sign Printable Pdf Template Signnow

Affidavit Of Self Employment 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

0 comments

Post a Comment